Table of Content

I took cash out of a tax deferred account losing any tax deferred gains while the loan was outstanding. I paid back my loan with after tax money deposited back into the tax deferred account. So some portion of my withdrawals have been taxed twice by Uncle Sam.

As mentioned above, this is the less desirable of the two options. Before diving into whether you should use your 401 to buy a house, it’s important to first have a firm grasp on how, exactly, a 401 retirement account works. Once you have a better idea of how much you need to save, it’s time to take advantage of automation.The goal of automation is to take the challenge out of saving. After all, the hardest part is consistently making the choice to put funds away. However, building savings that aren’t automatically taken out of your paycheck is often a bigger challenge.

Our mission is to empower women to achieve financial success.

As an early withdrawal, the IRS will impose a 10% penalty on the funds. Let’s say you decide to take an early withdrawal of $10,000. The downside is that you’ll have to pay the penalty if you withdraw funds before age 59.5. Unfortunately, it can get expensive quickly to pull funds out of your 401k to cover a down payment. But it is an option if you decide that it makes sense for your situation.

On the other hand, USDA loans have income limits and rules on where you can live. In most circumstances, with an early withdrawal, you’ll face a 10% fee on any amount you withdraw. For example, if you withdraw $10,000, you’ll pay a $1,000 fee.

How much can you take out of your 401(k) to buy a house without penalty?

IRAs have special provisions for first-time homebuyers and people who haven’t owned a primary residence in the last two years. With a Roth 401, you can withdraw all your contributions with no taxes and penalties, but any earnings would be subject to taxation. Learn how to tap your 401 to buy a home and more about some alternatives for funding a home purchase, such as using a mortgage program or saving up cash. If you need cash for a down payment for a home, and you have a 401 retirement plan, you might be wondering if you can use these funds.

• Conventional 97 loans are Fannie Mae-backed mortgages that allow a loan-to-value ratio of up to 97% of the cost of the loan. In other words, the home buyer could purchase a house for $400,000 and borrow up to $388,000, leaving only a down payment requirement or 3%, or $12,000, to purchase the house. • FHA loans are insured by the Federal Housing Administration and allow home buyers to borrow with few requirements.

Tennessee First-Time Home Buyer Programs and Grants of 2022

Members should be aware that investment markets have inherent risks, and past performance does not assure future results. Investor Junkie has advertising relationships with some of the offers listed on this website. Investor Junkie does attempt to take a reasonable and good faith approach to maintaining objectivity towards providing referrals that are in the best interest of readers. Investor Junkie strives to keep its information accurate and up to date.

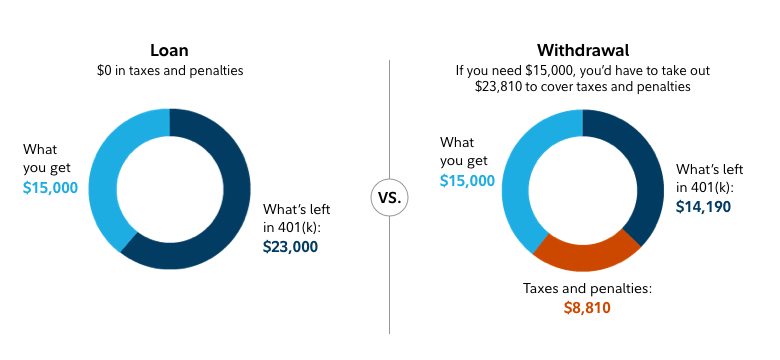

You can take out a 401 loan for a few different reasons (e.g., qualified educational expenses, medical expenses), depending on your plan’s policies. Those using a loan to purchase a residence may have more time to pay back the loan. Using 401 to buy a house before you are 59.5 years old may be very expensive considering the penalties and taxes that need to be paid for early withdrawal. Luckily, there are other ways a buyer can raise the funds for the house. In addition, you’re limited in the amount to $50,000 or half the vested value, whichever is greater.

Rocket Mortgage® has experts waiting to help you navigate the tricky waters of home loans. If you’re ready to take that next step toward a mortgage, then get preapproved today. This process involves your prospective home being reviewed by an FHA-approved appraiser. The home must also be your primary residence and you must occupy it within 60 days of closing the purchase. Your second option would be to make a direct 401 withdrawal for your home purchase.

With a Roth 401, you can withdraw the money you’ve contributed at any time tax- and penalty-free. However, if you withdraw earnings on your invested contributions before age 59½, you must pay taxes on them. “I try to tell people, you’re borrowing from your future if you’re doing that,” he says. You can withdraw funds from your 401K account to pay for a primary residence. When you borrow against your 401, you do not get the early withdrawal penalty. You don’t have to pay taxes on the amount you use, either.

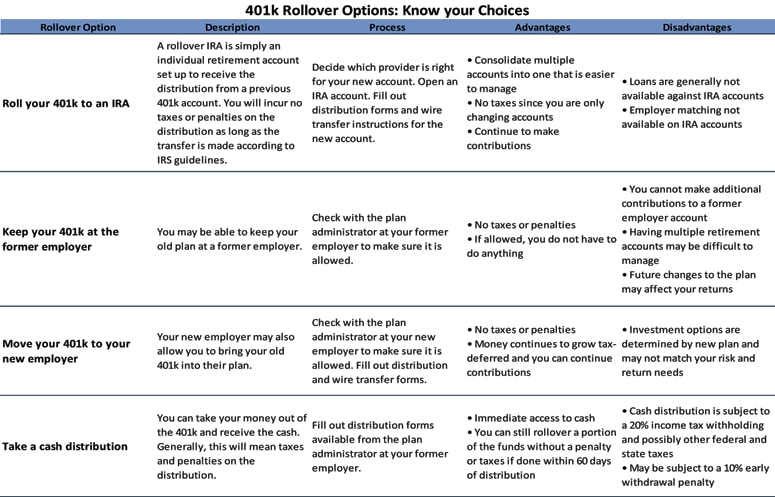

However, you can’t roll over a 401k that’s with an employer for whom you are still working. If you have an old 401k from a former employer, roll that. Since a rollover can take time to process, fill out the necessary paperwork as soon as possible.

You are now leaving the SoFi website and entering a third-party website. SoFi has no control over the content, products or services offered nor the security or privacy of information transmitted to others via their website. We recommend that you review the privacy policy of the site you are entering.